Home BASE-ics #3: Negative Sales

Most people talk about cashing out on their homes and using their property as a vehicle to grow their wealth. However, few mention the pitfalls that lie in the wait of unsuspecting homeowners.

In this article, we’ll be talking about one of the biggest pitfalls that unsuspecting homeowners can meet: a negative sale.

What’s a Negative Sale?

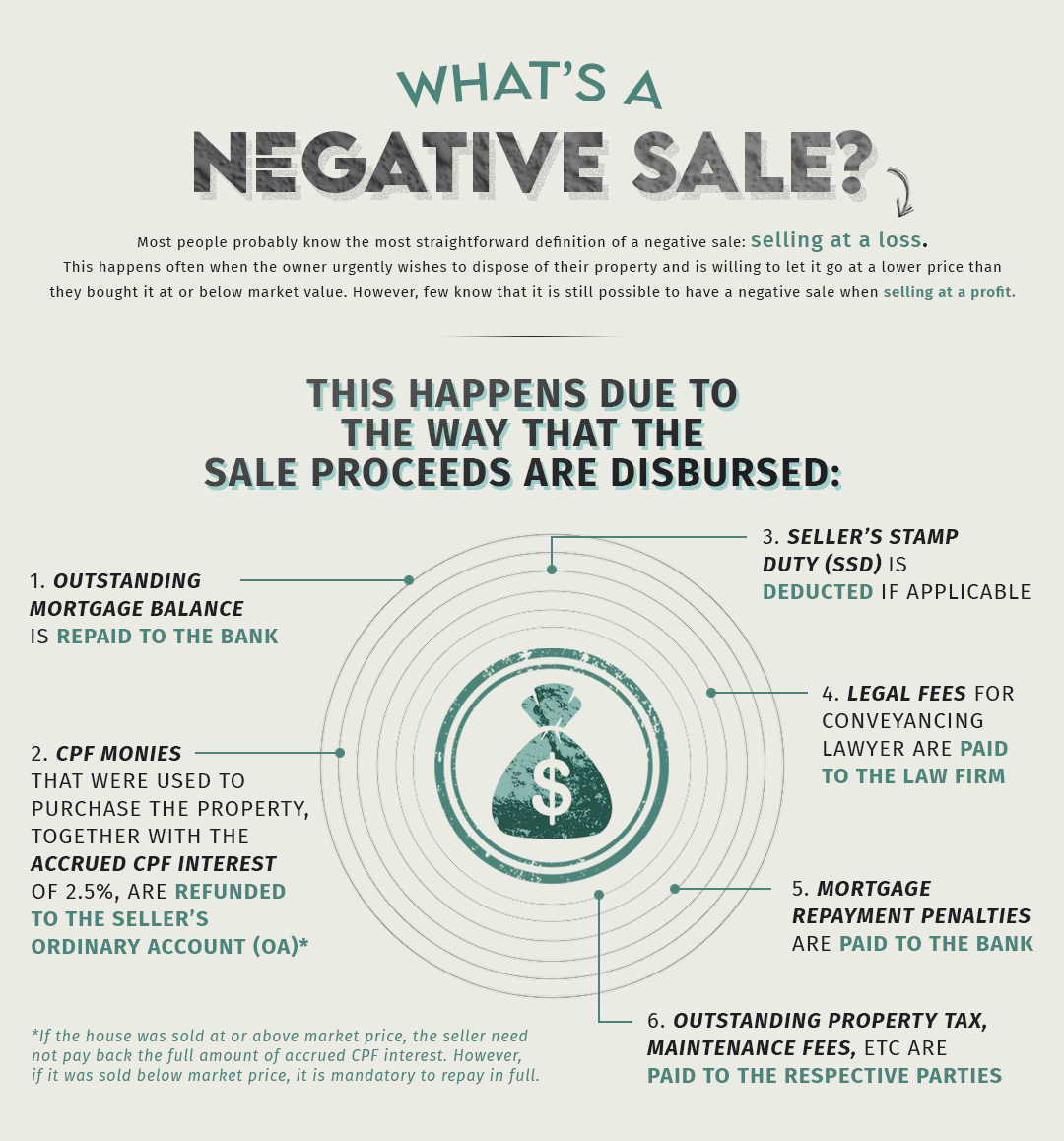

Most people probably know the most straightforward definition of a negative sale: selling at a loss. This happens often when the owner urgently wishes to dispose of their property and is willing to let it go at a lower price than they bought it at or below market value.

However, few know that it is still possible to have a negative sale when selling at a profit.

This happens due to the way that the sale proceeds are disbursed:

- The outstanding mortgage balance is repaid to the bank

- CPF monies that were used to purchase the property, together with the accrued CPF interest of 2.5%, are refunded to the seller’s Ordinary Account (OA)*

- Seller’s Stamp Duty (SSD) is deducted if applicable

- Legal fees for conveyancing lawyer are paid to the law firm

- Mortgage prepayment penalties are paid to the bank

- Outstanding property tax, maintenance fees, etc are paid to the respective parties

*If the house was sold at or above market price, the seller need not pay back the full amount of accrued CPF interest. However, if it was sold below market price, it is mandatory to repay in full.

The remaining amount after all these deductions will be the cash proceeds from the sale.

Here’s an example of how a negative sale can occur despite selling at a profit:

How to Avoid a Negative Sale?

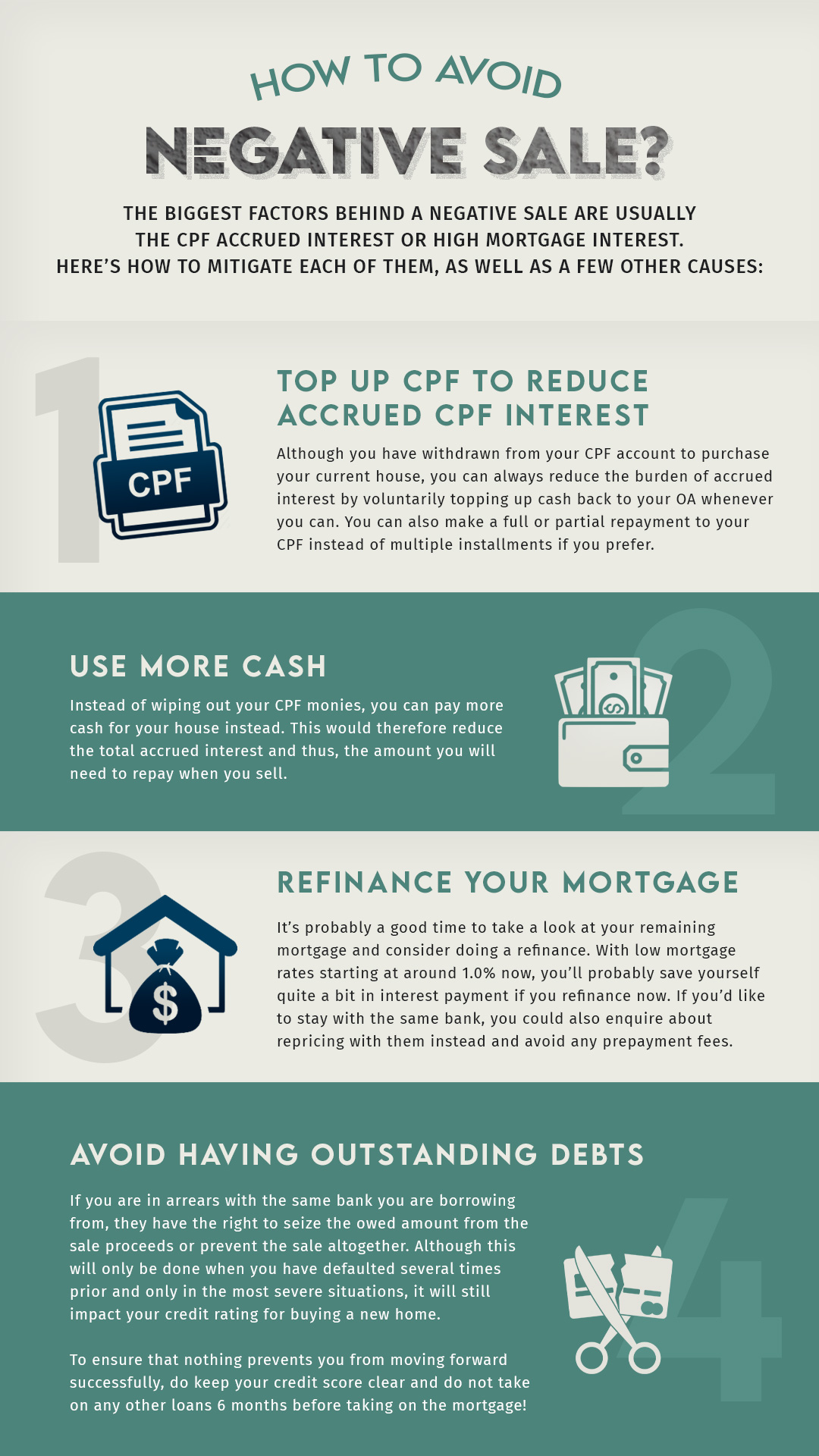

The biggest factors behind a negative sale are usually the CPF accrued interest or high mortgage interest. Here’s how to mitigate each of them, as well as a few other causes:

1. Top up CPF to reduce accrued CPF interest

Although you have withdrawn from your CPF account to purchase your current house, you can always reduce the burden of accrued interest by voluntarily topping up cash back to your OA whenever you can. You can also make a full or partial repayment to your CPF instead of multiple installments if you prefer.

2. Use more cash

Instead of wiping out your CPF monies, you can pay more cash for your house instead. This would therefore reduce the total accrued interest and thus, the amount you will need to repay when you sell.

3. Refinance your mortgage

It’s probably a good time to take a look at your remaining mortgage and consider doing a refinance. With low mortgage rates starting at around 1.0% now, you’ll probably save yourself quite a bit in interest payment if you refinance now. If you’d like to stay with the same bank, you could also enquire about repricing with them instead and avoid any prepayment fees.

4. Avoid Having Outstanding Debts

If you are in arrears with the same bank you are borrowing from, they have the right to seize the owed amount from the sale proceeds or prevent the sale altogether. Although this will only be done when you have defaulted several times prior and only in the most severe situations, it will still impact your credit rating for buying a new home.=

To ensure that nothing prevents you from moving forward successfully, do keep your credit score clear and do not take on any other loans 6 months before taking on the mortgage!

4. Avoid Having Outstanding Debts

If you are in arrears with the same bank you are borrowing from, they have the right to seize the owed amount from the sale proceeds or prevent the sale altogether. Although this will only be done when you have defaulted several times prior and only in the most severe situations, it will still impact your credit rating for buying a new home.

To ensure that nothing prevents you from moving forward successfully, do keep your credit score clear and do not take on any other loans 6 months before taking on the mortgage!

4. Avoid Having Outstanding Debts

Many homeowners often worry about the process of buying a new home, however, few realise that there are still pitfalls that can occur while staying in their new home. In particular, the accrued CPF interest continues to compound every year, increasing the likelihood of a negative sale.

Some may think that it is not too serious an issue as they do not intend to move from their current home in the future. However, unexpected events occur, some of which may make moving a necessity. Even without the intention to move, it is still important to keep our options open for when we need them.

Curious to know whether your home would incur a negative sale? Contact us for a consultation and we’ll help you calculate the costs and plan a strategy!