Home BASE-ics #1: Planning For MOP

If you currently own a BTO HDB flat, you’re probably aware of the Minimum Occupation Period (MOP).

That’s the 5 year period during which you are required to live in your flat before you are allowed to sell.

Not many people buy homes thinking about selling it after a few years (unless it’s an investment property). Many homeowners buy their homes intending to live there permanently, but just as many are looking to move due to not getting the BTO they wanted. This may impact the market of your unit, and you never know when you may change your mind!

Over the years we’ve been in the business, we’ve met clients who move not because they planned to, but because ‘things happen’. Like:

- Wanting an address within 1km of a popular primary school to enrol their children

- Needing more space to accommodate a growing family/aging parents

Other times, opportunity comes knocking:

- Experiencing an increase in income and wanting to upgrade

- Retirement planning through property investment

- Cashing out on unexpected capital gains

Five years is a long time in anyone’s life. Although you may have bought your home not intending to move ever again, you may experience a change of heart as the end of the MOP nears. Some extra cash could come in handy to fund your children’s education, two bedrooms might eventually become a tight squeeze for a couple with three growing kids now, or it may simply be time to move to a swankier, gated community so that you can enjoy full condo facilities and the kids can play outdoors safely.

Whichever it is, here’s a quick rundown of the options that you’ll have when your HDB flat finally reaches MOP:

#1 - Upgrading/Upsizing

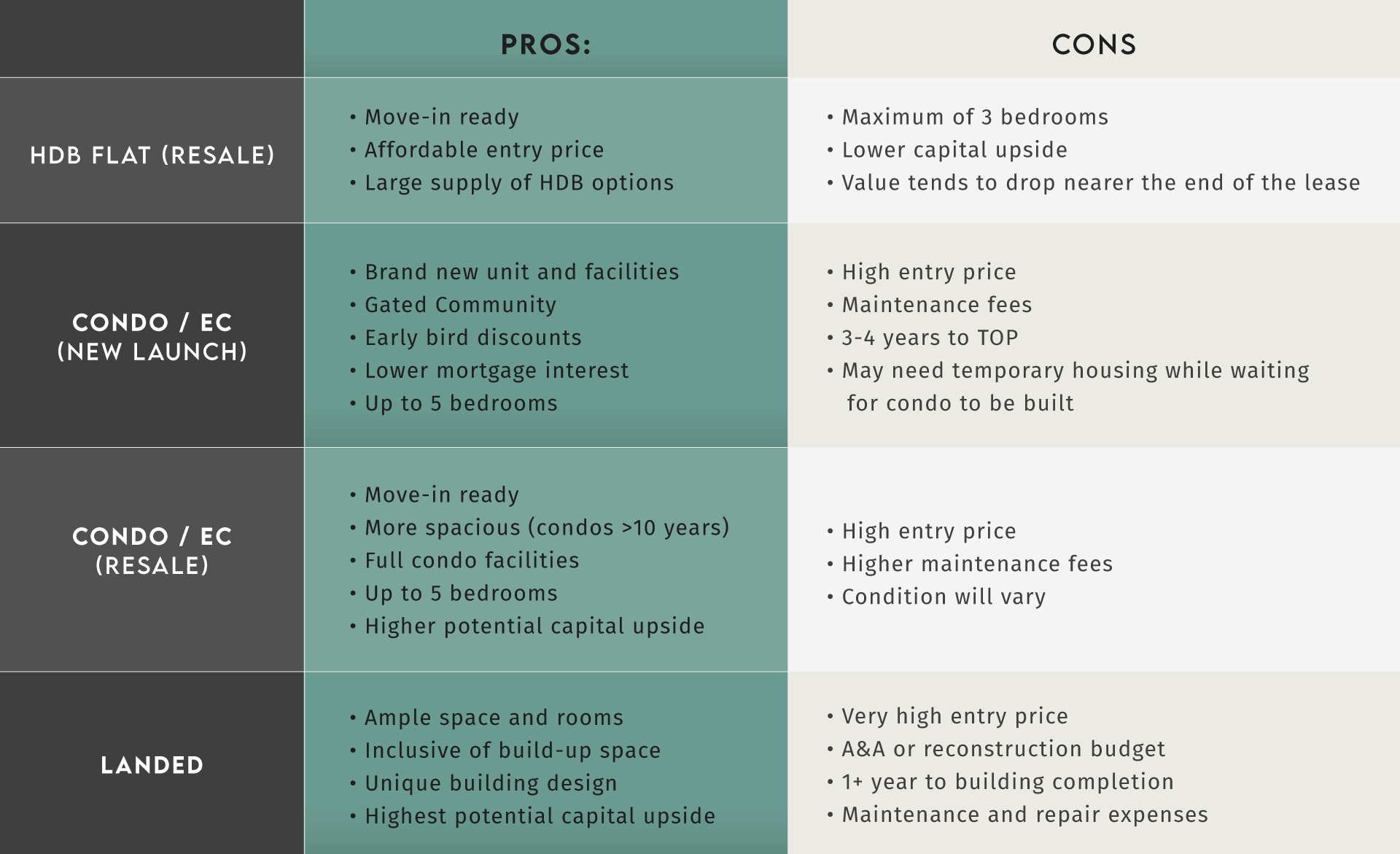

An upgrade or upsize is an exciting event for your family! Not only are you moving to a new home, but it’s also another milestone in your property journey and proof of how far you have come since five years ago. For homeowners looking to upgrade from a newly MOP-ed HDB flat, there are four main options:

- Upsizing to a bigger resale HDB flat

- Upgrading to a new launch EC/private condo

- Upgrading to a resale condo

- Upgrading to landed property

The first three are much more common due to the high entry prices that landed properties command.

If upgrading seems to be your cup of tea, start planning your cash flow. The most common strategy is to use the sale proceeds from selling your HDB to pay the deposit for your next home. Make sure that you are setting a competitive asking price by comparing prices of similar units within your block and in the same area.

#2 - Cashing Out

Cashing out refers to the process of selling your property after a few years in order to profit from its capital gains. In some cases, it’s just a simple sale process, however, it’s usually a little more complicated.

Homeowners looking to cash out have these options:

- Downsizing to a smaller HDB flat

- Relocating from a mature estate to a non-mature estate

- A combination of the previous two

The benefits? Having more cash on hand.

Honestly, that’s quite an unbeatable perk. Cash is always king, be it for emergency use or long term planning. In addition, you can always invest a portion of the cash into other investment vehicles or use it to fund your child’s education. Simply having more cash on hand can expand your options greatly.

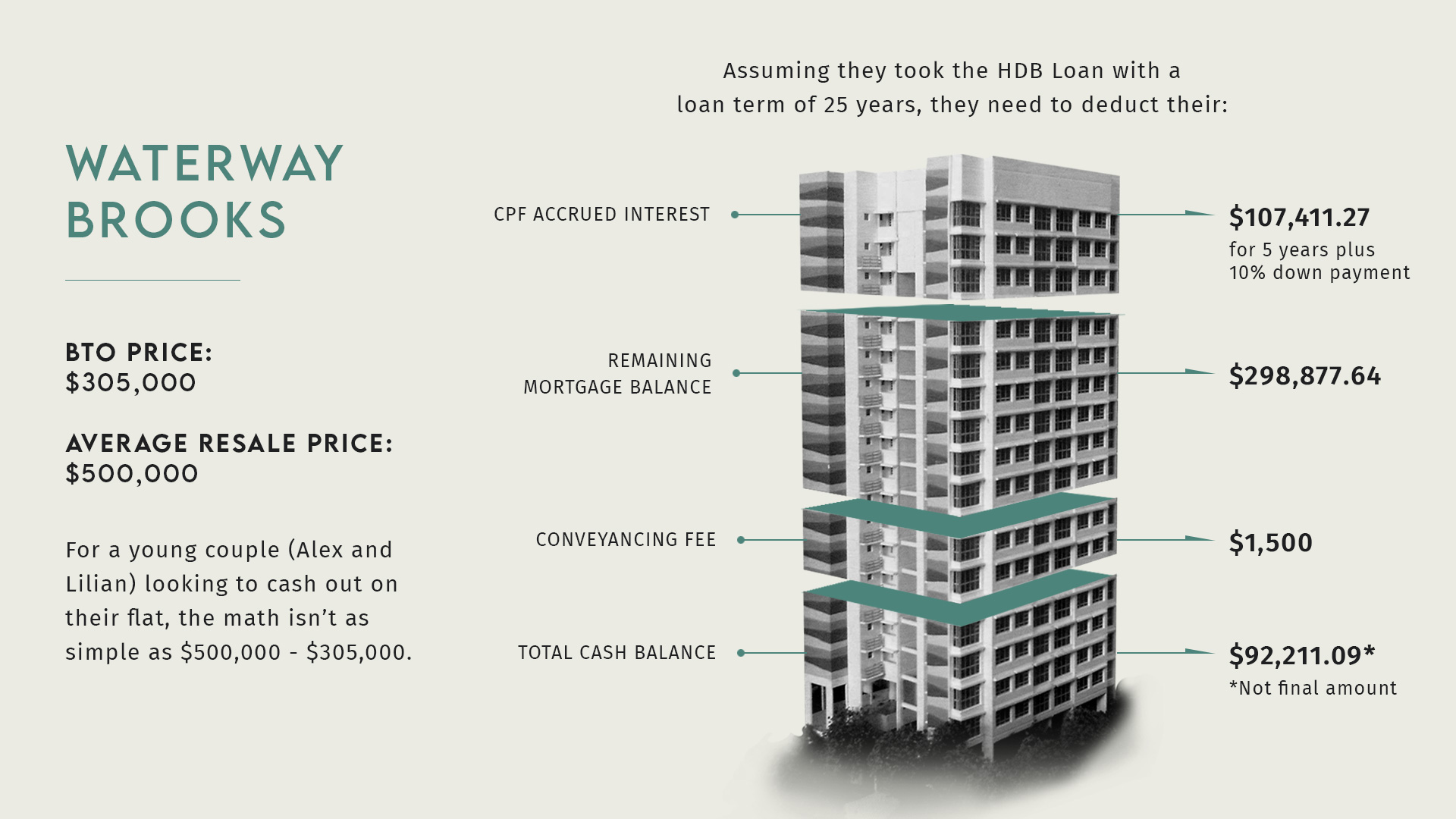

For a clearer idea of how much can be cashed out from a newly MOP-ed property, check out this simplified calculation of potential cash proceeds for the sale of a newly MOP 4-room HDB in Waterway Brooks, Punggol below:

Too many things can change in five years for a growing family. $90,000+ in cash would definitely be very helpful to ease the financial burden of raising children, servicing the family car, etc.

Of course, it is essential to ensure that you will always have a roof over your head even after cashing out on your property! Through our signature B.A.S.E Strategy, we’ll factor in the need for alternate accommodation or the purchase of a new home. Through this, your cash out journey with us will be smooth and worry-free from start to end.

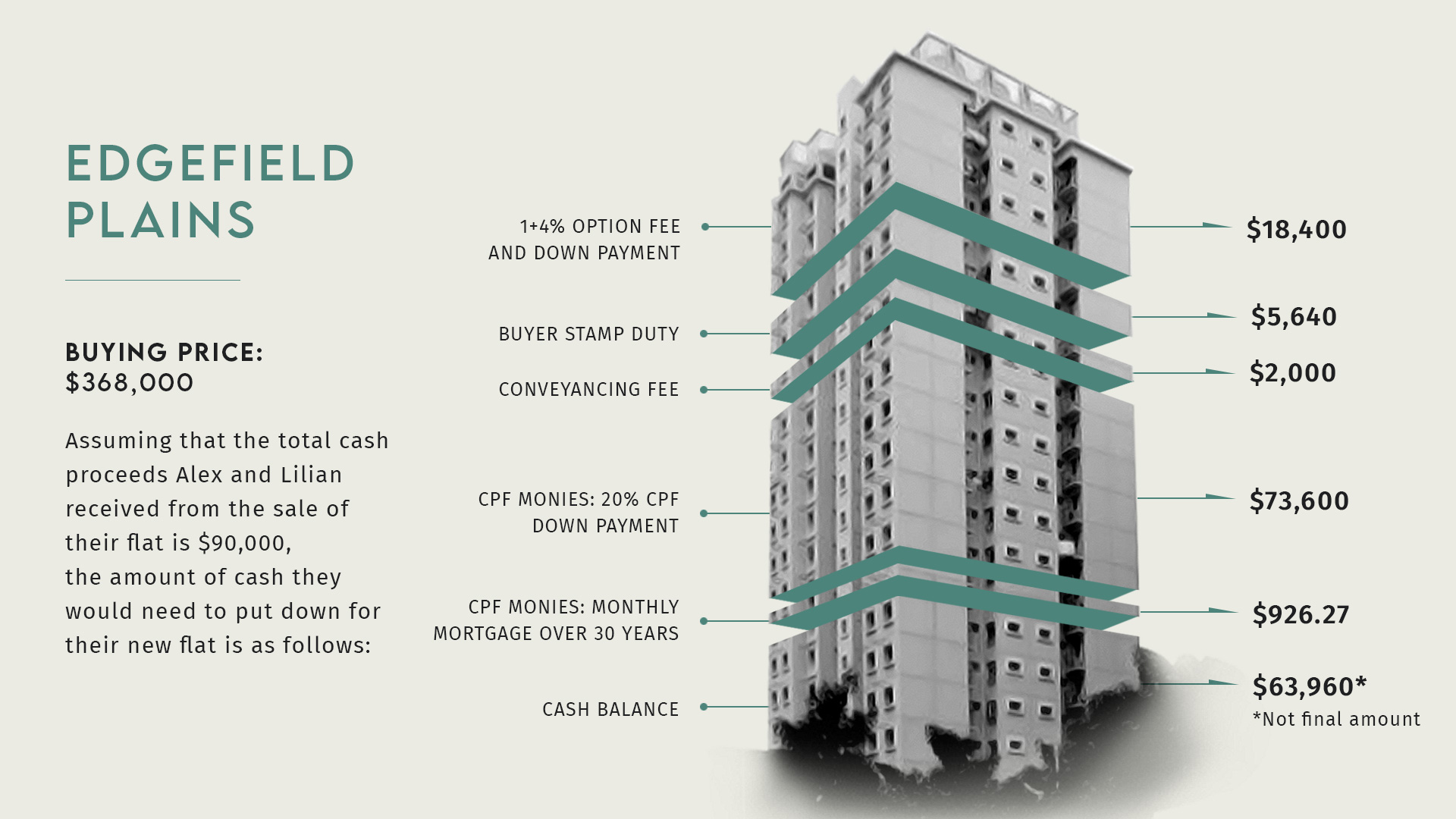

Here’s the follow-up of the previous case study, where the couple chose to downsize within the same area, Punggol. They selected a 3-room flat in Edgefield Plains, also a newly MOP-ed HDB development.

Even after buying a new home, Alex and Lilian would still have over $60,000 in cash to put into investments or for their child’s education!

#3 - Staying On

Finally, if there’s no real need to move, nothing is preventing you from continuing to live in your current home! When things are going well and it’s not worth the hassle of moving house once again, then it is a perfectly valid choice to continue staying.

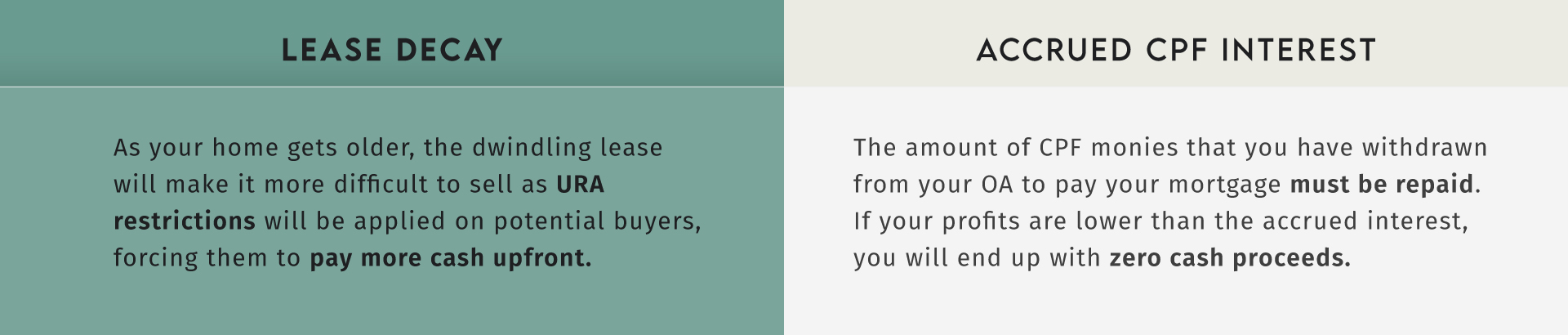

However, it is still important to keep your options open in the event they are needed (you never know when your parents may need to move in with you!). It would be worse if there was a need to upgrade/upsize but you were unable to due to having incurred a negative sale.

Here are some things to note:

Ultimately, the decision of whether to continue staying in your current home lies with you. However, do keep an eye open for opportunities in the market!

So How Do I Prepare to Upgrade/Cash Out?

Both upgrading and cashing out typically involves selling your property. That means prepping it nicely so that it can appeal to your buyers (and possibly nab you a higher price!).

For more specific advice, it’s best to engage an agent to evaluate your home, however, it doesn’t mean that there’s nothing you can do yourself to improve your chances of getting a buyer. Here are a few tips to help attract buyers!

Decluttering

Five years of living can generate plenty of junk, especially when children are involved (you won’t believe how quickly they outgrow their clothes, toys, pram, etc). Sometimes it may seem a bit of a pity to toss something that’s never been used.

Well you know what? If you’ve never used it, you’re unlikely to use it in the future. Garage sales on Carousell may be a good option to dispose of pre-loved items while getting some money back or you can donate them to the Salvation Army for a good cause.

Repainting

Peeling ceilings and cracked walls? Time to get out the paintbrush! DIY-ing your repainting project will definitely help reduce costs immensely. Just remember to get a primer with the paint, and to apply at least two coats!

If you’d prefer to leave it to a professional though, interior painters in Singapore charge upwards of $600 depending on the size of your home.

Small Renovations/Fixes

No, we’re not advocating for any full-blown renovations! The changes we’re suggesting are actually more similar to maintenance fixes than renovations (although they are categorised under it). Presentability is definitely of utmost importance in making a sale, however quirky additions and design preferences probably won’t last long as most buyers intend to make changes of their own!

Instead, focus on repairing wear and tear, like:

- Removing warped or rotted carpentry

- Changing sagging doors and door hinges

- Covering up cracks, holes and exposed wiring

- Replacing discoloured surfaces like false ceilings or wallpapering

- Plugging up leaks

Not only will these give you better ROI, they won’t clash with a buyer’s vision. After all, everyone wants to add a dash of their own personality into their new home!

Conclusion

Even if you don’t intend to move out of your house, it is still better to be aware of the options you have on hand. Not only will you be able to seize opportunities as they come, but you will also have the stronger holding power to outwait market lows.